Base Lending Rate BLR 66 Maximum Loan Amount 90 of property price. HDFC is currently offering home loan interest rates starting from 670 pa.

What Is Progressive Interest And Billing

Select the duration of the loan you plan to take.

. Tenure over 20 years Monthly Repayment RM258675. Best Low Interest Rate Housing Loans in Malaysia 2022. Tenure - The tenure or the period is the time within which you repay your loan.

Malaysia Housing Loan Interest Rates. R Monthly interest rate. Principal - The principal is the loan amount that you avail from Bank.

Click on Apply for Home Loan Step 3. Lower principal will lower your EMI and vice versa. RHB Housing Loan Our RHB Housing Loan with flexible options is the key to quickly own your dream house.

R Annual Rate of interest12100. Citibank Malaysia provides effective base lending or interest rates on standard housing loan time deposits foreign currency accounts and savings account. What are the current home loan interest rates.

The exemption applies for a maximum loan amount of RM500000. 465 BR - 39 Citibank FlexiHome Loan. How Homeownership Has Changed Since The Great Housing Bubble And Crash.

Outstanding Principal x Interest Rate12 Interest payable per instalment RM450000 x 00025 RM1125. It means longer tenure makes EMIs cheaper and vice versa. In summary Home Loan Repayment Most people will take up a house loan from a bank to help them purchase a property.

Customers can avail these home loan interest rates along with benefits like a longer loan tenure of up to 30 years end to end. Your housing loan interest rate determines your monthly payable EMI against your home loan. Overdraft Loan - This loan requires you to only pay for the interest rate of the loan and the amount will be deducted directly from.

A home ownership initiative for first-time buyers. At the time of writing the average base rates of Malaysian banks are between 175 275 pa. Compare Housing Loans in Malaysia 2022.

Bank Negara Malaysia BNM although dealing with low inflation compared with many other economies unexpectedly raised its key overnight policy rate by 25 basis points to 200 at its May meeting. If rate of interest is 72 pa. You need to assess your requirement and apply for the most suitable housing loan.

For East Malaysia we are available daily from. You also need to set the maximum percentage of your income that will go to repaying the housing loan. It is also directly proportional to your loan EMI.

It is also directly proportional to your car loan EMI. The interest rate on your gold loan varies depending upon the gold. The rate of interest R on your loan is calculated per month.

Rate of Interest - The rate of interest is the rate at which Bank offers you the car loan. The first small jet-powered civil aircraft was the Morane-Saulnier MS760 Paris developed privately in the early 1950s from the MS755 Fleuret two-seat jet trainerFirst flown in 1954 the MS760 Paris differs from subsequent business jets in having only four seats arranged in two rows without a center aisle similar to a light aircraft under a large. Tenure over 20 years Monthly Repayment RM252961.

Money Politics. What is Fixed rate of. A 320 all stamp duty chargeable on any loan agreement to finance the purchase of property worth in between RM300000 to RM500000 is remitted provided that it is 1st property purchased is for residential purpose and the sale and purchase agreement is signed in between 01072019 and 31122020.

If the loan amount is RM400000 the loan agreement stamp duty is RM400000 x 050 RM2000. Indicative Effective Lending Rate. My First Home Scheme.

A standard housing loan product refers to a housing loan product with loan amount of RM350000 for 30 years and has no lock-in period. Standard Chartered MortgageOne Interest Rate from 34 pa. How To Reduce Your Housing Loan Interest In Malaysia Article Feb 2022 What is a Home Loan Repayment.

Bank Fixed-Rate Home Loan Interest Rates. To find out the home loan amount you are eligible for click on Check Eligibility. What is the interest charge on gold loan.

For example If a person avails a loan of 1000000 at an annual interest rate of 72 for a tenure of 120 months 10 years then his EMI will be. 44 BR - 365 Hong Leong Housing Loan. As of 2nd January 2015 Base Lending Rate BLR has been updated to Base Rate BR to reflect the recent changes made by Bank Negara Malaysia and subsequently by major local banks the interest rate on a BR.

Under the Basic information tab select the type of housing loan you are looking for home loan house renovation loans plot loans etc. Best for loan amounts from RM300000. Apr-Jun 2022 Quarter Min Max Wt Avg.

Get interest rates from as low as 415 on your housing loan. Security for the loan will be pledge of 22 ct. The actual repayment may be different than the amount shown in the schedule in the event the interestprofit rate increases during the tenure of the loanfinancing facilityies.

As of July 2019 the Base Rate BR of housing loans in Malaysia were hovering around 3 - 4. HDFC offers you an option to convert from a Fixed Interest Rate Option to the Adjustable Interest Rate Option for the balance term of the loan. Protection of ceiling rate.

In case of a partly disbursed loan the fee payable to avail the conversion shall be 175 plus applicable taxes of the principal outstanding plus the undisbursed loan amount. What are the factors affecting housing loan EMI. Interest rates for housing loans in Malaysia are usually quoted as a percentage below the Base Rate BR.

For example if the current BR rate is 400 Update. However gross borrowing costs are substantially higher than the nominal interest rate and amounted for the last 30 years to 1046 per cent. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more.

Typically financial institutions in Malaysia will only lend to. However in the United States the average interest rates for fixed-rate mortgages in the housing market started in the tens and twenties in the 1980s and have as of 2004 reached about 6 per cent per annum. For a gold loan applicants should be individuals aged above 18 years and should have gold that needs to be pledged with the bank.

Rate of Interest - The rate of interest is the rate at which Bank offers you the loan. Interest rates for home loans in Malaysia are based on Base Rates BR which lay out the minimum interest rate banks give on home loans. Benefits Low Monthly Commitments for the first 5 years.

Public Bank MORE Plan. Student loan refinancing lower interest rate lower payment. What is the Eligibility for Gold Loan.

Best interest rate home loan. If the loan amount is RM500000 the stamp duty for the loan agreement is RM500000 x 050 RM2500. Bank of China Housing Loan Interest Rate from 315 pa.

Interest Rate Range for the past quarter for advances granted to individual borrowers. The loan agreement Stamp Duty is 050 from the loan amount. Then r 7212100 0006.

Bank Name Home Loan Interest Rate. Mean 640. It is inversely proportional to EMI.

The Bank of China Malaysias base rate for this loan is made up of two parts benchmark cost of funds COF and the Statutory Reserve Requirement SRR cost imposed by Bank Negara Malaysia. A redraw facility lets you access extra funds from your home loan.

Finance Malaysia Blogspot Update Local And Foreign Banks Mortgage Loan Rate As Of 6 March 2020

Malaysia Interest Rate Malaysia Economy Forecast Outlook

Asb Loan A Comparison Of All Asb Loan Options In Malaysia

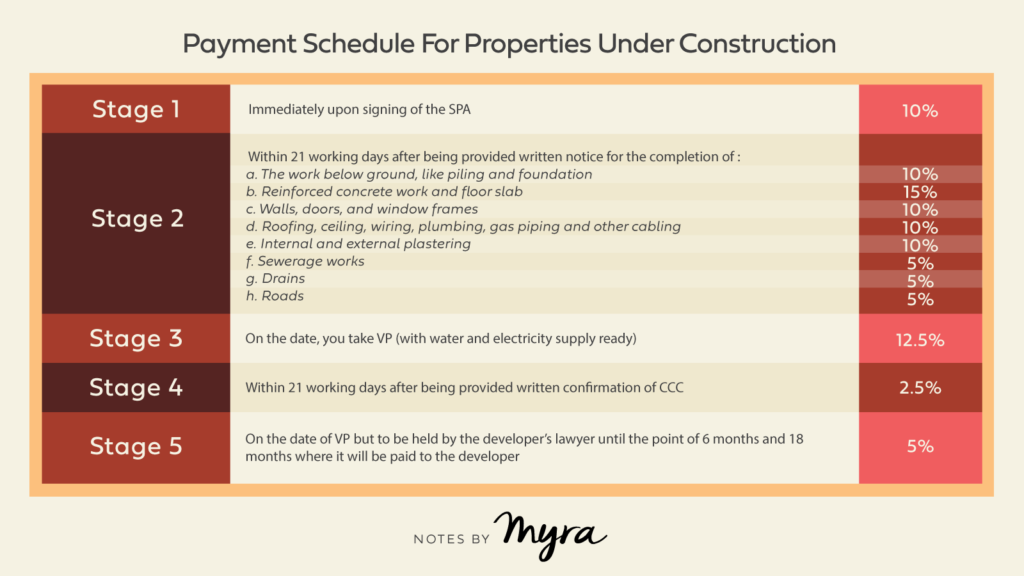

Malaysia Property Progressive Payment Schedule Mypf My

Malaysia Housing Loan Interest Rate Nashcxt

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

Latest Base Rates Br Base Lending Rate Blr Interest Rates Mypf My

Lppsa An Easy Housing Loan Guide For Government Workers New Property Nuprop

Finance Malaysia Blogspot Update Local And Foreign Banks Mortgage Loan Rate As Of 6 March 2020

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

What Ails The Malaysian Residential Property Sector The Edge Markets

Mygov Managing Finance And Taxation Getting A Loan Financing Getting A Home Loan Public Sector Home Financing Information

New Reference Rate In Malaysia Effective 2nd January 2015 Base Rate Br

Base Rate Br Base Lending Rate Blr Standardised Base Rate Sbr All You Need To Know

The 7 Best Housing Loans In Malaysia 2022

The Difference Between Basic Term Semi Flexi And Full Flexi Loan

Finance Malaysia Blogspot Update Local And Foreign Banks Mortgage Loan Rate As Of 6 March 2020

6 Ways To Reduce Your Mortgage Repayment Faster

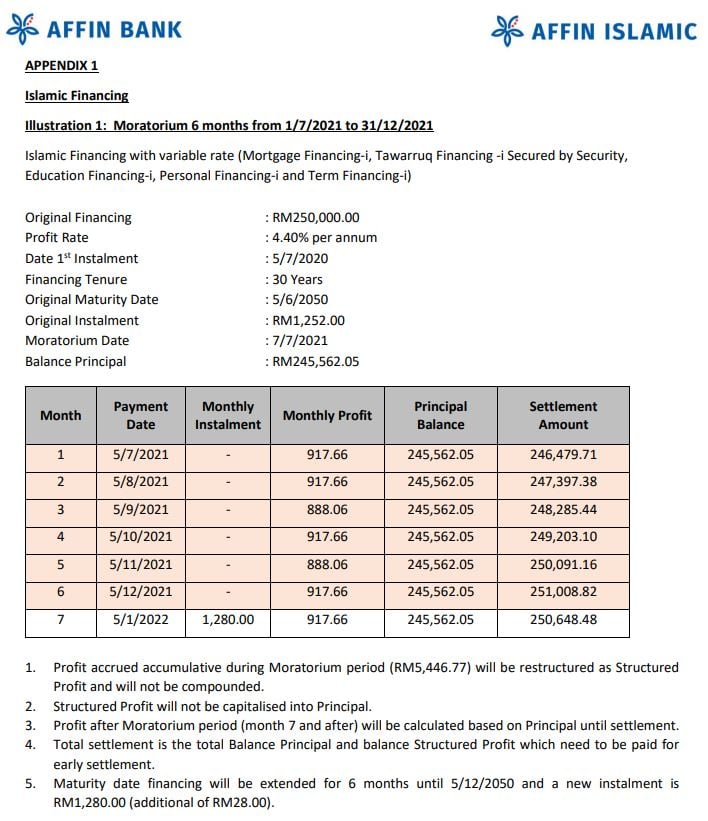

Malaysia Loan Moratorium 2021 Guide Should You Take The 6 Month Deferment For Your Loans